WILSON da SILVA

IT DOESN'T LOOK like the next Intel, nor even the next Cisco. But that’s where Redfern Photonics wants to be. And while that may be a big call, it doesn’t seem to faze the researchers-turned-businessmen behind this blossoming love-child of the Cooperative Research Centre program.

And for an outfit full of scientific muscle, it certainly has business pedigree. Chief executive Chris Howells founded NetComm, the modem manufacturer that grew to $30 million annual turnover before listing on the Australian Stock Exchange. Peter Davies, who started the San Francisco-based spin-off, Redfern Broadband Networks Inc, was managing director of listed company JNA Communications until it was acquired by Lucent in 1998 for $110 million.

What is most striking about Redfern Photonics, with its cutting-edge technology and blue sky potential, is just how seriously this company is taken by the big players. In an era of spectacular post dot-com bust-ups, that’s saying something. But they also have an easy confidence that suggests they know they are the Next Big Thing.

“Photonics is in high demand,” Howells says. “There’s a lot of stuff around computing which is the provenance of photonics. And in due course, someone might eventually [create] an optical computer.”

His betting is backed by Professor Rod Tucker, coordinator of telecommunications research at the University of Melbourne and director of its photonics labs. Redfern Photonics is among several Australian companies well-positioned to capitalise on the next revolution in telecommunications demand.

“The current slow-down in the telecommunications industry does not alter the fundamental fact that the demand for bandwidth will continue to increase in the medium to long term,” Tucker says.

“The key enabling technology will be optical networking ... this will usher in a new era of ultra-broadband network, that will ultimately be able to deliver as much as a Gigabit per second – one billion bits per second – to the home.”

So what’s all the excitement about? It comes down to light: photonics is the replacement of the electrons we use every day in computing and communications, with photons, or light. And while this is an essentially simple concept, the consequences are profound. Light can potentially carry many thousands of times the information content. Light is impervious to electromagnetic disruption – so no jamming or interference. And while electrons sort-of travel at the speed of light (barring hold-ups at copper wire routers and the such), light is the real thing.

The demand for more and ever faster information makes photonics a rapidly growing and potentially lucrative business. But it is also competitive. Since technological advances in the late 1980s made electron-to-photon switching over long distances not only possible but reliable, just about everyone has been trying to jump aboard.

What they find when they get there is that Redfern Photonics has mapped out a lot of the turf already. Through its labyrinth of subsidiaries and part-owned spin-offs, the company has staked out positions in most of the frontiers of this new field, from broadband switching to planar lightwave chips. And it has no intention of being bottom-feeder in this food chain: it aims to be at the top. Within five years.

To understand how Redfern Photonics got here, you have to understand the problems faced by telcos in the 1980s. Submarine cables were made of coaxial copper cables, which limited communication speeds and required hundreds of repeaters along the route.

Optical fibre then boosted capacity dramatically and spread those repeaters farther apart, but repeaters were still needed every 80 kilometres. Not only that, repeaters had to convert optical signals into electronic signals, boost them, then convert them back to optical and send them on. Very cumbersome.

Then came optical repeaters in 1986, which allowed the boosting of optical signals directly. This single development gave birth to the whole photonics industry; no longer held back by the need to repeatedly convert light to electrons and back along a cable, engineers could push the upper limits of optical fibre. And they did, triggering screaming demand for more bandwidth which in turn generated a massive demand for more optical fibre, switches and components.

In the 1990s came WDM, or wave division multiplexing; essentially, the ability to multiply the number of simultaneous channels transmitted down the same length of optical fibre. Previously, each fibre could carry only 2.5 gigabits per channel; WDM allowed two or more channels of 2.5 gigabits each to be sent down the same fibre.

These days, state-of-the-art WDM allows fibre to carry 96 channels simultaneously. But in the lab, scientists are now packing more than 200 channels per fibre. Advances are pushing capacity to 10 gigabits a channel, and recent advances suggest a target of 40 gigabits a channel is not far away. All of this at a time when scientists have yet to establish what the carrying capacity of optical fibre actually is: there are some who believe 500 channels a fibre may not be impossible. In fact, when it comes to the carrying capacity of data on optical fibre, no-one really knows what the ceiling is.

Redfern Photonics was born out of all this hive of commercial and innovation demand. It began as the commercialisation company of the Australian Photonics Cooperative Research Centre, one of the first CRCs established by the Federal Government in 1992.

Its members include the Australian National University, the universities of Melbourne, Sydney, New South Wales and RMIT, as well as ABB, Ericsson, JDS Uniphase, Telstra, TransGrid and the government-owned Defence Science and Technology Organisation. The CRC has already made some dosh along the way: it sold its unit INDX to JDS Uniphase in 1997, a division that has since grown 50-fold and now employs 300 staff.

But believing that the CRC’s intellectual and commercial muscle was not being appropriately valued, its partners reorganised their holdings in November 1998 to create Redfern Photonics. They split their proprietary technologies into seven subsidiaries, in two of which they now hold minority stakes.

Some are trading commercially and earning revenue, such as the Connecticut-based Nufern, which makes application-specific optical fibre. Others are research and development incubators for emerging technologies, such as Redfern Polymer Optics, which is developing planar lightwave chips and polymer-based optical fibre. Each is majority-owned by Redfern Photonics, which is itself majority held by the CRC’s shelf company, Australian Photonics Pty Ltd.

It may all sound a little complicated but this structure has been the key to harnessing the most from the intellectual property held by the CRC partners. It has allowed Redfern Photonics to roadshow its technologies separately and garner investors locally and overseas, both venture capital companies and potential commercial competitors.

“We did it initially so we could sell chunks,” says Howells, who became chief executive in 1998 after first joining the board of the CRC subsidiary INDX as a director three years earlier. “We couldn’t get people to successfully value [the complete business], but we could get individual chunks valued and this allowed us to realise the latent value of the group as a whole.”

The strategy has been a success: in just two years, Redfern Photonics has raised $220 million to fund its operations as well as its subsidiaries and spin-offs, and now employs more than 300 in the seven companies. The parent company last year successfully raised $54 million with a minority placement to a syndicate of investors led by Deutsche Bank.

If you believe Howells, you ain’t seen nothing yet. He calls photonics a “disruptive technology”, that will worm its way into just about everything to do with communication and computing. He’s not the only one: companies such as Kodak estimate the industry could be worth US$220 billion a year in a decade. The market for photonics components alone is forecast to be worth almost US$4.5 billion by 2004.

That raises the spectre of another Australian company sold to overseas interests as happened with wireless company Radiata, sold to Cisco two years ago, and network equipment maker JNA, bought by Lucent in 1998. It’s a prospect the University of Melbourne’s Professor Tucker does not shy away from.

“We can’t put our heads in the sand – we operate in a global economy and mergers and acquisitions are part of the global economy,” Tucker says. “The key is that we increase the number of companies in Australia participing in this economy.

“In the past, acquisitions of photonics companies in Australia have often been accompanied by increased investment in the local operation.”

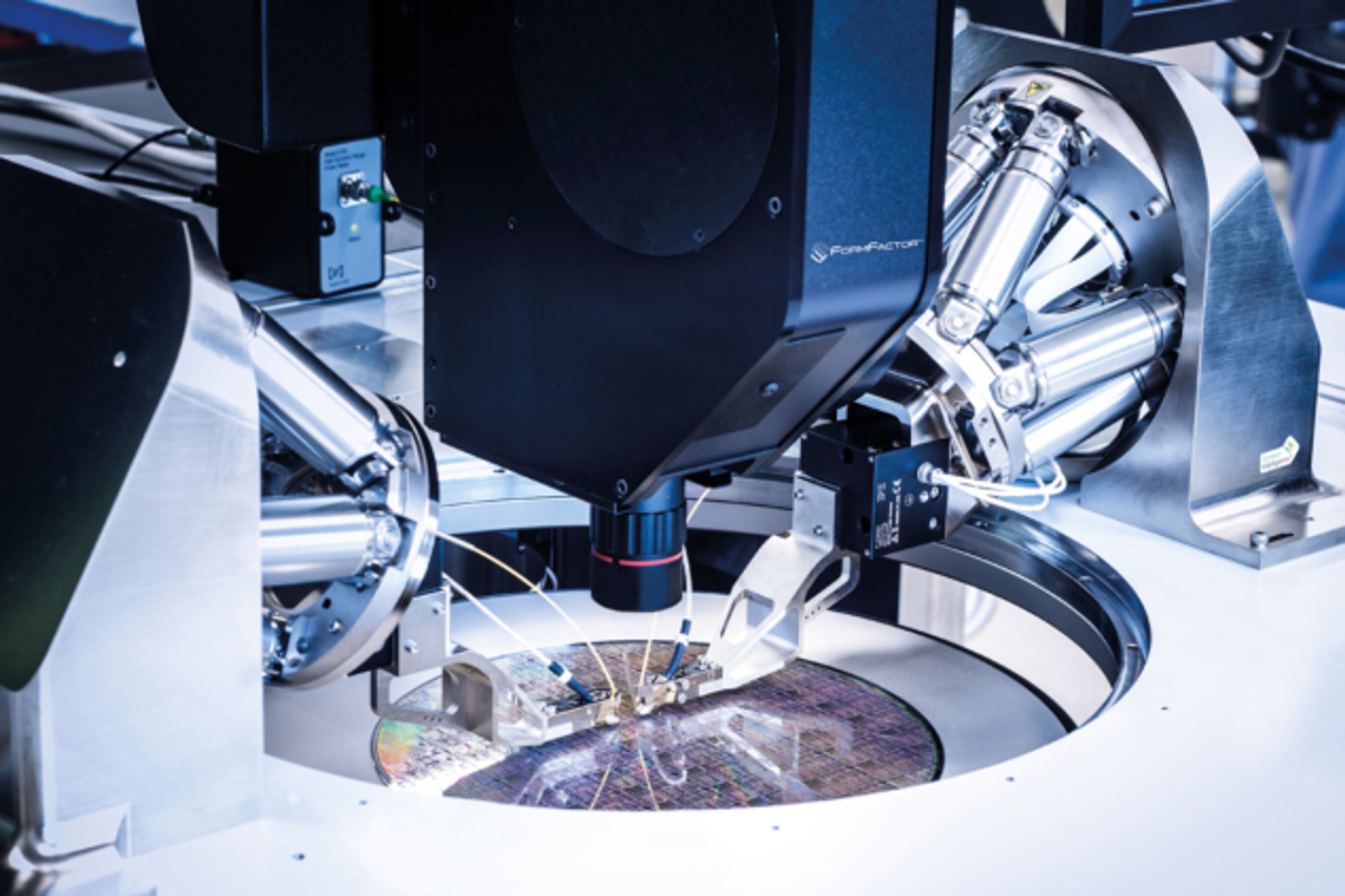

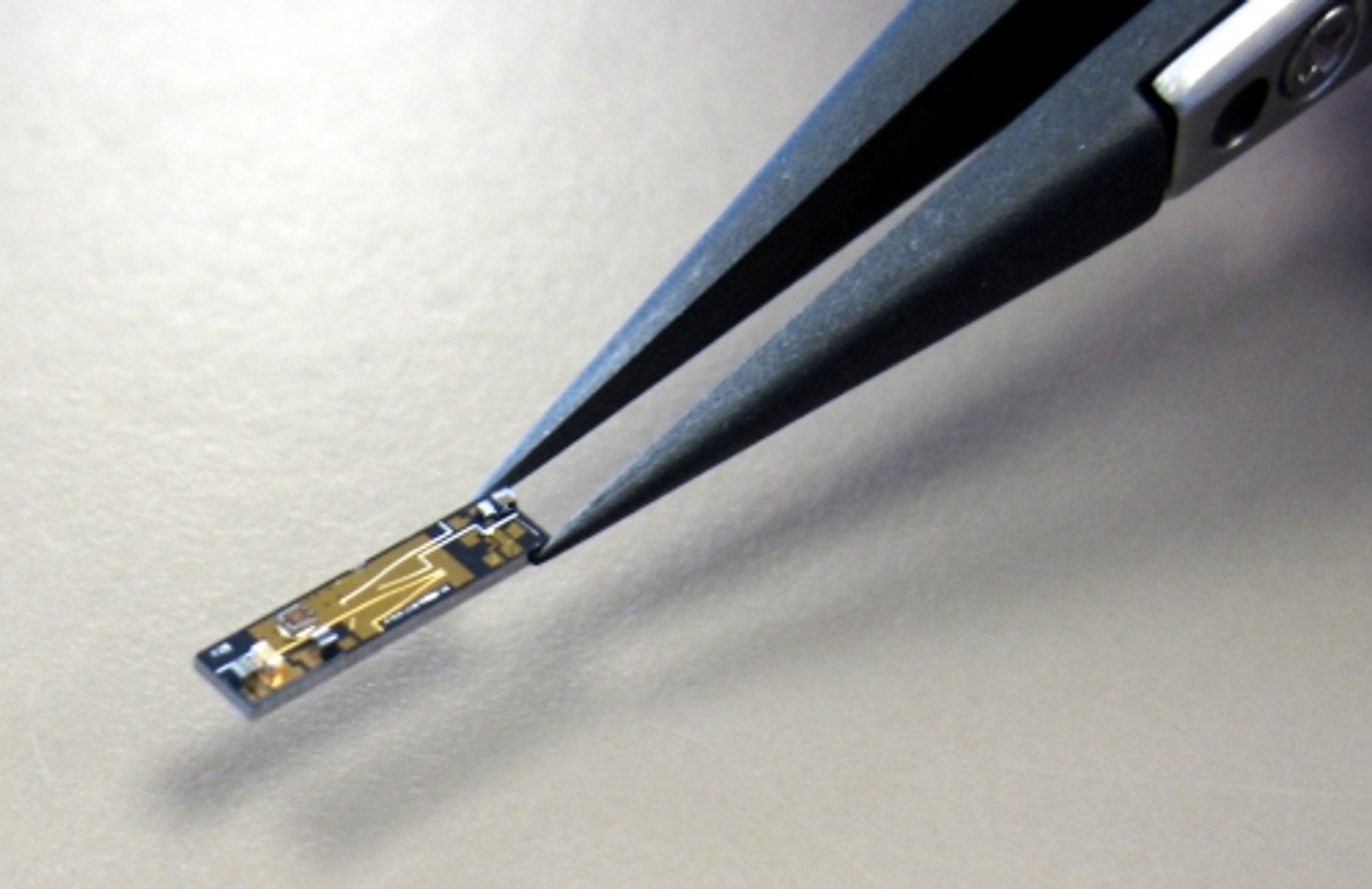

Take planar lightwave chips, devices with miniature optical components communicating by optical waveguides – a kind of microchip of the future. Made like semiconductors, the technology is in its early days but already promising the type of growth the semiconductor business went through. Then there’s the potential of using optics as a storage medium, to hold hundreds of gigabytes of information on a 1mm chip – another project being developed at the CRC.

“It could be the Intel of tomorrow,” Howells says. Not that he’s claiming Redfern Photonics will build the microchips of the future; just that the company is sitting on the kind of technologies that will dominate data communications this century and quite possibly give birth to the next computing revolution.

Nevertheless, it’s a big call but Howells is unfazed. Intel was nowhere 20 years ago, he says, and Cisco was a small networking company that grew at a 160 per cent annually to be the behemoth it is today. If you have the technology people want, you can rocket ahead.

“And we are potentially sitting on those technologies in the planar lightwave circuit business in our operation.”

Tucker is not so sure. Photonic components are not good at the most fundamental computing operations of logic and memory, he says. “My feeling is that optical computing in its classical sense is a pipe dream. Photonics is good for data transmission, electronics is good for data processing; I see no reason this should change soon.”

But even if the blue sky has receded a little, there’s plenty of big bucks to be made building the optical world. “There’s a lot more to photonics than just fibre and laser,” says Professor Mark Sceats, chief executive of the Australian Photonics CRC and a director of many of the Redfern companies. “There’s a plethora of devices required: amplifiers, modulators, channel drops, filters, signal processors, attenuators and isolators.”

What is photonics?

A beam of light is both a wave form and a stream of particles called photons. Photonics is the control, manipulation, transfer and storage of energy and information using photons. Light’s waveform and its ability to be transmitted at a range of frequencies provides the means of carrying multiple packages of information simultaneously. Photons can carry more information much faster than electrons. As a key enabling technology, photonics underpins the communications revolution with a myriad applications in areas of telecommunications, diagnostic equipment and sensing devices.