KEY TAKEAWAYS

- Energy prices, particularly gasoline, significantly influence public opinion and economic sentiment in the U.S.

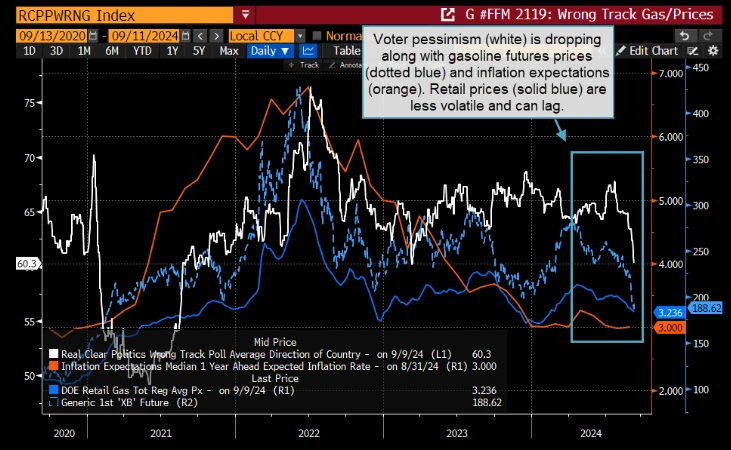

- Gasoline prices have fallen to $3.23 per gallon, with futures indicating continued price drops.

- Voter pessimism has started to decline as gasoline prices drop, with three-in-ten battleground state voters citing fuel costs as their most crucial economic issue.

Background

Energy prices, particularly gasoline prices, have long been a significant factor in shaping public opinion and economic sentiment in the United States. As we approach the 2024 presidential election, the relationship between energy costs and voter pessimism has become increasingly crucial for politicians, economists, and analysts to understand

The impact of energy prices extends beyond just the cost of filling up at the pump. It affects inflation rates, overall cost of living, and plays a role in shaping Federal Reserve policy. Historically, there has been a strong correlation between gasoline prices and voter sentiment, with higher prices often leading to increased pessimism among the electorate

PRODUCT MENTIONS

The Issue

The interplay between energy prices, particularly gasoline, and voter pessimism is complex, and traders and voters find themselves watching many of the same economic indicators.

Retail gasoline averages have fallen to $3.23 per gallon, cheaper than this April and down roughly 17% from this time last year. Futures signal continued price drops and gasoline product demand is close to a 10-year low for the week ending Sept. 9. Driving has returned to pre-pandemic levels, but fuel economy improvements and electric vehicle adoption may mean the global market is set for an outright decline.

Discover more with Bloomberg newsletters

Subscribe now

While voter pessimism rose alongside inflation in 2022, it’s dropping alongside gasoline futures prices and inflation expectations. Three-in-10- battleground state voters tell pollsters that fuel prices — “the most visible price in life” — are their most crucial economic issue. Analysts suggest watching the declining profitability of gasoline production because of the potential to lower run rates and reverse some of this collapse.

Tracking

Run Bloomberg’s CCRV to analyze gasoline futures curve shifts and check futures indicators. Use the GP – Line Chart for the RCPPWRNG Index to chart gasoline futures and inflation expectations against voter pessimism.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.